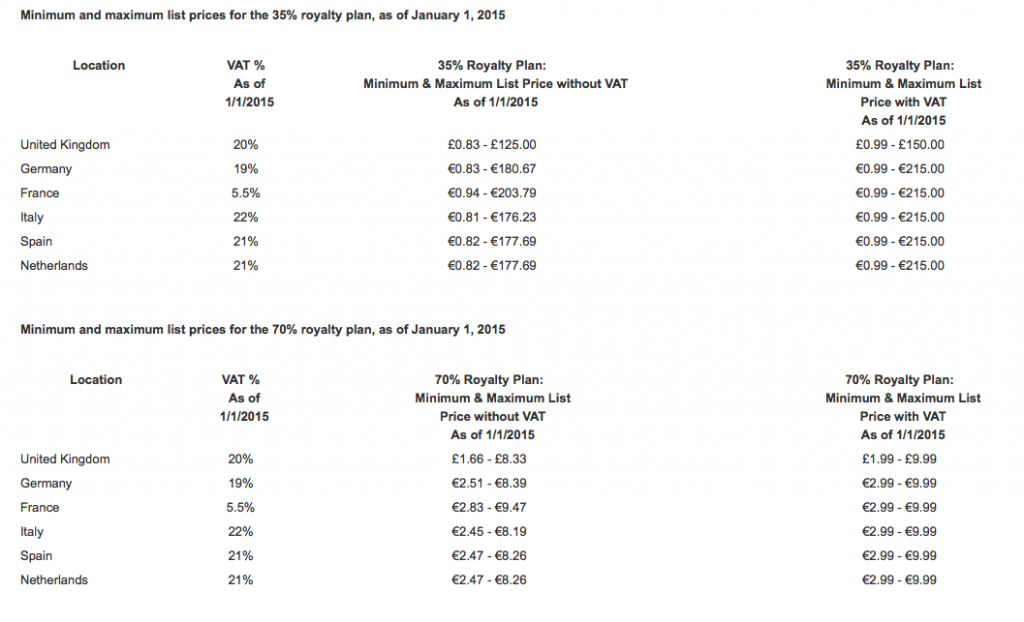

In a move that’s going to confuse self-publishers worldwide, Amazon revealed how VAT taxes are going to work for European sales of self-published books after January 2015.

On January 1, 2015, European Union (EU) tax laws regarding the taxation of digital products (including eBooks) will change: previously, Value Added Tax (VAT) was applied based on the seller’s country – as of January 1st, VAT will be applied based on the buyer’s country. As a result, starting on January 1st, KDP authors must set list prices to be inclusive of VAT. We will also make a one-time adjustment for existing books published through KDP to move from VAT-exclusive list prices to list prices which include VAT. We’ll put these changes into effect starting January 1st; you may always change your prices at any time, but you do not need to take any action unless you wish to do so.

One-time Adjustment for Existing KDP Titles

Starting January 1st, for any titles already published in KDP, we will make a one-time adjustment to convert VAT-exclusive list prices provided to us to VAT-inclusive list prices. Subject to minimum and maximum thresholds, we will add the applicable VAT based on the primary country of the marketplace to the VAT-exclusive list price provided. For example, if an author had previously set £5.00 as the VAT-exclusive list price for amazon.co.uk, the new VAT-inclusive list price will be £6.00 because the applicable VAT rate in the UK is 20%. Please note, if an author had set a consistent VAT-exclusive list price for all Euro based Kindle stores, those prices will now be different due to varying VAT rates for the primary country of each Kindle store. For example, if an author had previously provided a €6.00 VAT-exclusive list price for amazon.de, amazon.fr, amazon.es, and amazon.it Kindle stores, the list prices including VAT will be €7.14 (19% VAT), €6.33 (5.5% VAT), €7.26 (21% VAT), and €7.32 (22% VAT) respectively.

Minimum and maximum list prices for the 35% and 70% royalty plans will now also include VAT. For books published before January 1st that would fall outside these new limits after VAT is included, we will adjust the list price to ensure the book remains in the same royalty plan that was previously selected.

To see if your books meet the VAT requirements, click here for complete info.

Basically, you’re going to need to charge a pound or Euro more in the UK/Europe. Given that this is going to mess with a lot of indie publishers’ bottom line, there’s a petition to uphold the VAT exemption.

Read more at the Telegraph: New EU VAT rules threaten to kill UK micro firms. It includes Joanna Penn’s tweet:

Because of #VATMOSS #VATMESS I will likely stop direct digital sales to customers & use only big corporate platforms. Nice one @HMRCgovuk

— Joanna Penn (@thecreativepenn) November 25, 2014

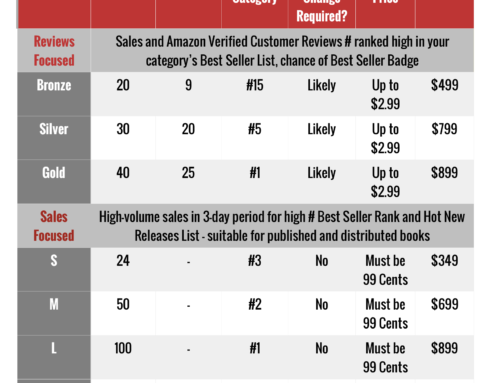

Get an Editorial Review | Get Amazon Sales & Reviews | Get Edited | Get Beta Readers | Enter the SPR Book Awards | Other Marketing Services

Leave A Comment